An article published yesterday by Modern Healthcare forecasts growth in healthcare hiring this year in many healthcare provider segments, but not in acute care. With diminishing revenues and a shift in patient preferences towards outpatient facilities and ambulatory surgery centers, acute care facilities will either freeze hiring or consider small layoffs. At Valify we expect hospitals to take additional steps to address their shrinking margins by identifying outsourcing opportunities, placing pressure on procurement teams to get ahead of the curve in identifying and evaluating these purchased services.

While outsourcing arrives with the promise of increased efficiencies, it brings along many challenges aside from the obvious emotional ones. When vendor selection is non-transparent, unstructured, or decentralized the hospital can find itself saddled with sub-optimal terms, and what appears to be a financial win can turn into another upward pressure on costs. Additionally, when decisions are made without complete and accurate data about the hospital’s current spending patterns, the hospital can lose much-needed power at the negotiating table to win price concessions.

For these very reasons there has been a shift in who has responsibility for contracting with service providers, moving it out of the hands of department heads and into those of the procurement team. The disciplined approaches to RFP design, vendor selection, and negotiation can help the hospital achieve the savings that it badly needs. With the required data in hand these teams can find opportunities to improve margins by identifying consolidation opportunities.

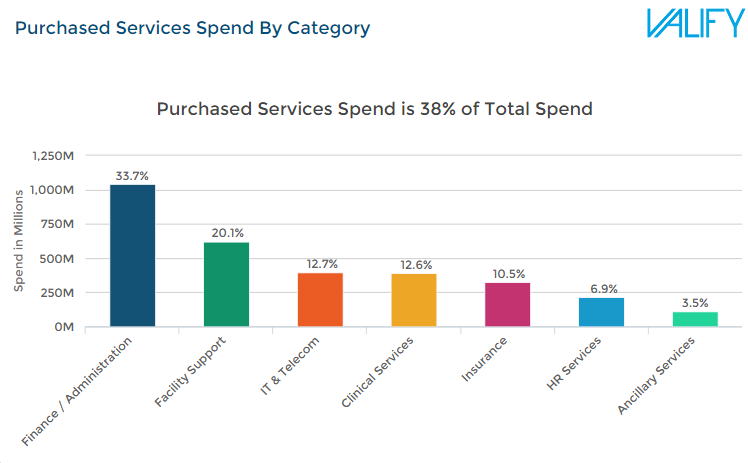

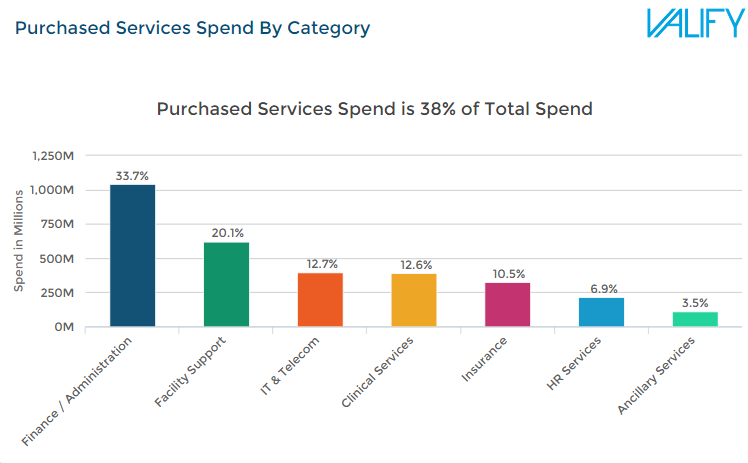

In Valify’s Purchase Services Intelligence (PSI) database, we analyzed the spending patterns in 2014 to identify where hospitals are spending the most money on service contracts. Purchased services make up 38% of a hospital’s non-labor spend. Finance and administration seems to take the lion’s share of the purchased services budget, however, most of that is consumed by rent and related finance charges. By far the largest category is facility support services at 20.1% of the total purchased services budget, with utilities, bio-med, and food service (distribution and catering) as the largest subcategories. Procurement teams should expect to have this breadth of data, as well as detailed information on where they are spending money and with whom.

Procurement teams can follow this structured approach to analyze their purchased services spend:

1) Collect Spend Data

Gather the complete non-labor spend and ensure that you look at an entire year so that you account for seasonal fluctuations. While the A/P will be the primary source for information, you’ll want to also collect your P-card information and any spending handled outside of accounts payable to ensure that you have the full picture.

2) Categorize

This can be a challenging endeavor, with wide variations in accounts payable categories and vendor names. While you might be able to trust portions of the G/L for categorization, the disconnect between accounts payable and where the services are received often means that the categorization is too high level or completely inaccurate. Use of an analytics platform focused on purchased services can simplify this step. Make sure your solution to this problem is not dependent upon a team of analysts, as this can make the process prone to error.

3) Identify Areas for Savings

Our blog post presents a structured approach to creating and prioritizing a purchased services savings work plan for the year, but at a high level you’re looking for the areas with the highest spend and a large number of vendors. These situations present clear opportunities for vendor consolidation.

The coming year presents both challenges and opportunities for hospital administration and procurement teams. By following these steps to identify savings opportunities in purchased services, hospitals can put themselves in a better position to handle the current financial environment.